| « Back |

First Quarter 2022 Operational Highlights:

- Total number of registered users reached 171 million as of

March 31, 2022 , representing an increase of 29.4% from 132 million as ofMarch 31, 2021 ; and users with credit line reached 37.8 million as ofMarch 31, 2022 , up by 24.8% from 30.3 million as ofMarch 31, 2021 . - As of

March 31, 2021 , we cumulatively originatedRMB702 billion in loans, an increase of 40.7% fromRMB499 billion a year ago. - User base

- Number of active users1 who used our loan products in the first quarter of 2022 was 5.7 million, representing a decrease of 30.7% from 8.2 million in the first quarter of 2021.

- Number of new active users who used our loan products in the first quarter of 2022 was 0.7 million, representing a decrease of 63.1% from 1.8 million in the first quarter of 2021.

- Loan facilitation business

- Total loan originations2 in the first quarter of 2022 was

RMB43.2 billion , a decrease of 19.8% fromRMB53.8 billion in the first quarter of 2021. - Total outstanding principal balance of loans2 reached

RMB83.8 billion as ofMarch 31, 2022 , representing an increase of 1.7% fromRMB82.4 billion as ofMarch 31, 2021 . - Lexin has continued to expand financing services for small and micro business owners. In the first quarter, loan originations for small and micro business owners reached

RMB4.2 billion . - Number of orders placed on our platform in the first quarter of 2022 was 27.9 million, representing a decrease of 64.6% from 78.6 million in the first quarter of 2021.

- Credit performance

- 90 day+ delinquency ratio was 2.40% as of

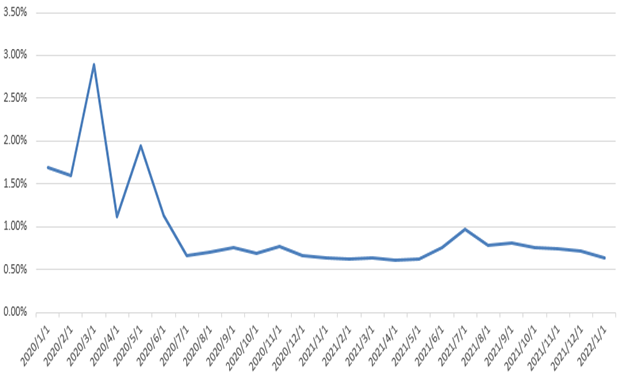

March 31, 2022 . - First payment default rate (30 day+) for new loan originations was below 1% as of

March 31, 2022 . - Technology-Driven Platform Services

- In the first quarter of 2022, we had served over 100 customers with our technology-driven platform services.

- In the first quarter of 2022, our customer retention rate3 of technology-driven platform services was over 80%.

- New Consumption-Driven, Location-Based Services

- The GMV4 in the first quarter of 2022 amounted to

RMB 669 million , representing a decrease of 10.7% fromRMB749 million in the first quarter of 2021. - In the first quarter of 2022, we served over 271,000 users and 2,300 merchants under new consumption-driven, location-based services.

- Other operational highlights

- The weighted average tenor of loans originated on our platform in the first quarter of 2022 was approximately 12.3 months, representing an increase from 11.7 months in the first quarter of 2021. The nominal APR5 was 14.4% for the first quarter of 2022, representing a decrease from 15.5% in the first quarter of 2021.

1. Active users refer to, for a specified period, users who made at least one transaction during that period through our platform or through our third-party partners’ platforms using credit line granted by us.

2. Originations of loans and outstanding principal balance represent the origination and outstanding principal balance of both on- and off-balance sheet loans.

3. Customer retention rate refers to the number of financial institution customers and partners who repurchase our service in the current quarter as a percentage of total number of financial institution customers and partners in the preceding quarter.

4. GMV refers to the total value of transactions completed for products purchased on our e-commerce and Maiya channel, net of returns.

5. Nominal APR refers to all-in interest costs and fees to the borrower over the net proceeds received by the borrower as a percentage of the total loan originations of both on- and off-balance sheet loans.

First Quarter 2022 Financial Highlights:

- Total operating revenue was

RMB1,712 million , representing a decrease of 41.8% from the first quarter of 2021. Revenue from new consumption-driven, location-based services wasRMB319 million , representing a decrease of 26.2% from the first quarter of 2021. Revenue from technology-driven platform services wasRMB497 million , representing a decrease of 26.3% from the first quarter of 2021. Revenue from credit-driven platform services wasRMB896 million , representing a decrease of 51.2% from the first quarter of 2021. - Gross profit was

RMB461 million , representing a decrease of 66.3% from the first quarter of 2021. - Net income attributable to ordinary shareholders of the Company was

RMB78.1 million , representing a decrease of 89.0% from the first quarter of 2021. Net income per ADS attributable to ordinary shareholders of the Company wasRMB0.42 on a fully diluted basis. - Non-GAAP EBIT6 was

RMB156 million , representing a decrease of 82.8% from the first quarter of 2021. - Adjusted net income attributable to ordinary shareholders of the Company6 was

RMB129 million , representing a decrease of 83.2% from the first quarter of 2021. Adjusted net income per ADS attributable to ordinary shareholders of the Company6 wasRMB0.62 on a fully diluted basis.

6. Non-GAAP EBIT, adjusted net income attributable to ordinary shareholders of the Company, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company are non-GAAP financial measures. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures Statement” and the tables captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

First Quarter 2022 Financial Results:

Operating revenue decreased from

Revenue from new consumption-driven, location-based services decreased by 26.2% from

Revenue from technology-driven platform services decreased by 26.3% from

Revenue from credit-driven platform services decreased by 51.2% from

Loan facilitation and servicing fees-credit oriented decreased by 75.9% from

Interest and financial services income and other revenues decreased by 28.6% from

Guarantee income increased by 8.0% from

Cost of sales decreased by 24.3% from

Funding cost decreased by 27.4% from

Processing and servicing cost increased by 16.6% from

Provision for credit losses of financing and interest receivables was

Provision for credit losses of contract assets and receivables decreased by 67.5% from

Provision for credit losses of contingent liabilities of guarantee increased by 11.7% from

Gross profit decreased by 66.3% from

Sales and marketing expenses remained stable from

Research and development expenses increased by 22.8% from

General and administrative expenses decreased by 10.8% from

Change in fair value of financial guarantee derivatives and loans at fair value was a gain of

Income tax expense for the first quarter of 2022 was

Net income for the first quarter of 2022 was

Conference Call

The Company’s management will host an earnings conference call at

Participants who wish to join the conference call should register online at:

http://apac.directeventreg.com/registration/eveqnt/5865035

Please note the Conference ID number of 5865035.

Once registration is completed, participants will receive the dial-in information for the conference call, an event passcode, and a unique registrant ID number.

Participants joining the conference call should dial in at least 10 minutes before the scheduled start time.

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at http://ir.lexin.com.

A replay of the conference call will be accessible approximately two hours after the conclusion of the live call until

| 1 855 452 5696 or 1 646 254 3697 | |

| International: | 61 2 8199 0299 |

| Replay Access Code: | 5865035 |

About

Lexin is a leading online and offline consumption platform and a technology-driven service provider in

For more information, please visit http://ir.lexin.com.

To follow us on Twitter, please go to: https://twitter.com/LexinFintech.

Use of Non-GAAP Financial Measures Statement

In evaluating our business, we consider and use adjusted net income attributable to ordinary shareholders of the Company, non-GAAP EBIT, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company, four non-GAAP measures, as supplemental measures to review and assess our operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with

We present these non-GAAP financial measures because it is used by our management to evaluate our operating performance and formulate business plans. Adjusted net income attributable to ordinary shareholders of the Company enables our management to assess our operating results without considering the impact of share-based compensation expenses, interest expense associated with convertible notes, and investment (loss)/income. Non-GAAP EBIT, on the other hand, enables our management to assess our operating results without considering the impact of income tax expense, share-based compensation expenses, interest expense, net, and investment (loss)/income. We also believe that the use of these non-GAAP financial measures facilitates investors’ assessment of our operating performance. These non-GAAP financial measures are not defined under

These non-GAAP financial measures have limitations as an analytical tool. One of the key limitations of using adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT is that they do not reflect all items of income and expense that affect our operations. Share-based compensation expenses, interest expense associated with convertible notes, income tax expense, interest expense, net, and investment (loss)/income have been and may continue to be incurred in our business and are not reflected in the presentation of adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT. Further, these non-GAAP financial measures may differ from the non-GAAP financial information used by other companies, including peer companies, and therefore their comparability may be limited.

We compensate for these limitations by reconciling the non-GAAP financial measure to the most directly comparable

Exchange Rate Information Statement

This announcement contains translations of certain RMB amounts into

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the

For investor and media inquiries, please contact:

IR inquiries:

Tel: +86 (755) 3637-8888 ext. 6258

E-mail: jamiewang@lexin.com

Media inquiries:

Tel: +86 (755) 3637-8888 ext. 6993

E-mail: liminchen@lexin.com

SOURCE

Unaudited Condensed Consolidated Balance Sheets

| As of | |||||||||

| (In thousands) | |||||||||

| RMB | RMB | US$ | |||||||

| ASSETS | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | 2,664,132 | 2,303,519 | 363,371 | ||||||

| Restricted cash | 1,305,435 | 1,454,431 | 229,431 | ||||||

| Restricted time deposits | 1,745,898 | 1,851,454 | 292,060 | ||||||

| Short-term financing receivables, net of allowance for credit losses of |

3,772,975 | 4,174,599 | 658,527 | ||||||

| Loans at fair value | 252,970 | 281,712 | 44,439 | ||||||

| Accrued interest receivable, net of allowance for credit losses of |

53,513 | 63,552 | 10,025 | ||||||

| Prepaid expenses and other current assets | 941,150 | 982,696 | 155,016 | ||||||

| Amounts due from related parties | 6,337 | 6,066 | 957 | ||||||

| Deposits to insurance companies and guarantee companies | 1,378,489 | 1,630,230 | 257,162 | ||||||

| Short-term guarantee receivables, net of allowance for credit losses of |

543,949 | 573,066 | 90,399 | ||||||

| Short-term contract assets and service fees receivable, net of allowance for credit losses of |

3,942,700 | 3,289,348 | 518,882 | ||||||

| Inventories, net | 47,816 | 56,528 | 8,917 | ||||||

| Total current assets | 16,655,364 | 16,667,201 | 2,629,186 | ||||||

| Non-current assets | |||||||||

| Restricted cash | 149,247 | 137,993 | 21,768 | ||||||

| Long-term financing receivables, net of allowance for credit losses of |

241,127 | 287,125 | 45,293 | ||||||

| Long-term guarantee receivables, net of allowance for credit losses of |

101,562 | 105,367 | 16,621 | ||||||

| Long-term contract assets and service fees receivable, net of allowance for credit losses of |

244,672 | 179,498 | 28,315 | ||||||

| Property, equipment and software, net | 195,330 | 214,654 | 33,861 | ||||||

| Land use rights, net | 966,067 | 957,467 | 151,037 | ||||||

| Long-term investments | 469,064 | 470,372 | 74,199 | ||||||

| Deferred tax assets | 1,176,878 | 1,298,484 | 204,831 | ||||||

| Other assets | 826,883 | 869,891 | 137,222 | ||||||

| Total non-current assets | 4,370,830 | 4,520,851 | 713,147 | ||||||

| TOTAL ASSETS | 21,026,194 | 21,188,052 | 3,342,333 | ||||||

| LIABILITIES | |||||||||

| Current liabilities | |||||||||

| Accounts payable | 15,705 | 25,378 | 4,003 | ||||||

| Amounts due to related parties | 23,102 | 24,539 | 3,871 | ||||||

| Short-term borrowings | 1,799,741 | 1,737,830 | 274,136 | ||||||

| Short-term funding debts | 3,101,381 | 2,373,313 | 374,381 | ||||||

| Accrued interest payable | 24,851 | 5,784 | 912 | ||||||

| Deferred guarantee income | 419,843 | 448,212 | 70,704 | ||||||

| Contingent guarantee liabilities | 928,840 | 867,676 | 136,873 | ||||||

| Accrued expenses and other current liabilities | 3,873,657 | 3,663,035 | 577,830 | ||||||

| Total current liabilities | 10,187,120 | 9,145,767 | 1,442,710 | ||||||

| Non-current liabilities | |||||||||

| Long-term funding debts | 696,852 | 1,776,061 | 280,167 | ||||||

| Deferred tax liabilities | 54,335 | 82,891 | 13,076 | ||||||

| Convertible notes | 1,882,689 | 1,876,133 | 295,953 | ||||||

| Other long-term liabilities | 137,389 | 127,748 | 20,152 | ||||||

| Total non-current liabilities | 2,771,265 | 3,862,833 | 609,348 | ||||||

| TOTAL LIABILITIES | 12,958,385 | 13,008,600 | 2,052,058 | ||||||

| SHAREHOLDERS’ EQUITY: | |||||||||

| Class A Ordinary Shares | 180 | 181 | 28 | ||||||

| Class B Ordinary Shares | 57 | 57 | 9 | ||||||

| - | (25,482 | ) | (4,020 | ) | |||||

| Additional paid-in capital | 2,918,993 | 2,954,693 | 466,091 | ||||||

| Statutory reserves | 901,322 | 901,322 | 142,180 | ||||||

| Accumulated other comprehensive income | 11,273 | 12,281 | 1,937 | ||||||

| Retained earnings | 4,195,791 | 4,273,890 | 674,189 | ||||||

| Non-controlling interests | 40,193 | 62,510 | 9,861 | ||||||

| TOTAL SHAREHOLDERS’ EQUITY | 8,067,809 | 8,179,452 | 1,290,275 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 21,026,194 | 21,188,052 | 3,342,333 | ||||||

Unaudited Condensed Consolidated Statements of Operations

| For the Three Months Ended |

|||||||||

| (In thousands, except for share and per share data) | 2021 | 2022 | |||||||

| RMB | RMB | US$ | |||||||

| Operating revenue: | |||||||||

| New Consumption-Driven, Location-Based Services (1) | 431,706 | 318,672 | 50,269 | ||||||

| Technology-Driven Platform Services (1) | 674,871 | 497,281 | 78,444 | ||||||

| Credit-Driven Platform Services (1) | 1,837,106 | 896,425 | 141,408 | ||||||

| Loan facilitation and servicing fees-credit oriented (1) | 1,060,420 | 255,739 | 40,342 | ||||||

| Interest and financial services income and other revenues (1) | 541,637 | 386,774 | 61,012 | ||||||

| Guarantee income (1) | 235,049 | 253,912 | 40,054 | ||||||

| Total operating revenue | 2,943,683 | 1,712,378 | 270,121 | ||||||

| Operating cost: | |||||||||

| Cost of sales | (433,469 | ) | (328,213 | ) | (51,774 | ) | |||

| Funding cost | (129,760 | ) | (94,253 | ) | (14,868 | ) | |||

| Processing and servicing cost | (396,716 | ) | (462,465 | ) | (72,952 | ) | |||

| Provision for credit losses of financing and interest receivables | (171,998 | ) | (45,529 | ) | (7,182 | ) | |||

| Provision for credit losses of contract assets and receivables | (218,937 | ) | (71,201 | ) | (11,232 | ) | |||

| Provision for credit losses of contingent liabilities of guarantee | (223,785 | ) | (249,892 | ) | (39,419 | ) | |||

| Total operating cost | (1,574,665 | ) | (1,251,553 | ) | (197,427 | ) | |||

| Gross profit | 1,369,018 | 460,825 | 72,694 | ||||||

| Operating expenses: | |||||||||

| Sales and marketing expenses | (345,504 | ) | (360,444 | ) | (56,859 | ) | |||

| Research and development expenses | (124,207 | ) | (152,506 | ) | (24,057 | ) | |||

| General and administrative expenses | (131,101 | ) | (116,997 | ) | (18,456 | ) | |||

| Total operating expenses | (600,812 | ) | (629,947 | ) | (99,372 | ) | |||

| Change in fair value of financial guarantee derivatives and loans at fair value | 75,761 | 262,868 | 41,466 | ||||||

| Interest expense, net | (19,689 | ) | (15,305 | ) | (2,414 | ) | |||

| Investment (loss)/ income | (189 | ) | 1,374 | 217 | |||||

| Other, net | 18,249 | 21,045 | 3,320 | ||||||

| Income before income tax expense | 842,338 | 100,860 | 15,911 | ||||||

| Income tax expense | (131,257 | ) | (19,377 | ) | (3,057 | ) | |||

| Net income | 711,081 | 81,483 | 12,854 | ||||||

| Less: net (loss)/ income attributable to non-controlling interests | (458 | ) | 3,384 | 534 | |||||

| Net income attributable to ordinary shareholders of the Company | 711,539 | 78,099 | 12,320 | ||||||

| Net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||

| Basic | 1.94 | 0.21 | 0.03 | ||||||

| Diluted | 1.74 | 0.21 | 0.03 | ||||||

| Net income per ADS attributable to ordinary shareholders of the Company | |||||||||

| Basic | 3.87 | 0.42 | 0.07 | ||||||

| Diluted | 3.49 | 0.42 | 0.07 | ||||||

| Weighted average ordinary shares outstanding | |||||||||

| Basic | 367,370,488 | 370,068,984 | 370,068,984 | ||||||

| Diluted | 414,600,356 | 372,075,542 | 372,075,542 | ||||||

__________________________

(1) Starting from the first quarter of 2022, we report our revenue streams in three categories - new consumption-driven, location-based services, technology-driven platform services, and credit-driven platform services, to provide more relevant and updated information. We also revised the revenue presentation in comparative periods to conform to the current classification.

In providing new consumption-driven, location-based services, we provide platform and services for merchants, shopping malls, and brands to conduct sales and marketing, with the goal to drive transaction volume, for which we charge a service fee. Revenue earned from the online direct sales and services is recognized under new consumption-driven, location-based services, which was previously reported as “Online direct sales” and “Other services” within “Online direct sales and services income” before the change of presentation.

In providing technology-driven platform services, we offer a comprehensive set of services to our customers that enable them to increase revenues, manage financial risks, improve operating efficiency, improve service quality, enhance collections, and reduce overall costs. Revenue earned from platform-based services, membership services and other services is reported as one combined financial statement line item under “Technology-driven platform services.” The membership fees and other services revenue were previously reported as “Membership services” and “Other services” within “Online direct sales and services income” before the change of presentation.

The revenue earned from credit-oriented services is recognized under credit-driven platform services, which includes "Loan facilitation and servicing fees-credit oriented," "Interest and financial services income and other revenues," and "Guarantee income."

Unaudited Condensed Consolidated Statements of Comprehensive Income

| For the Three Months Ended |

|||||||||

| (In thousands) | 2021 | 2022 | |||||||

| RMB | RMB | US$ | |||||||

| Net income | 711,081 | 81,483 | 12,854 | ||||||

| Other comprehensive (loss)/ income | |||||||||

| Foreign currency translation adjustment, net of nil tax | (2,071 | ) | 1,008 | 159 | |||||

| Total comprehensive income | 709,010 | 82,491 | 13,013 | ||||||

| Less: net (loss)/ income attributable to non-controlling interests | (458 | ) | 3,384 | 534 | |||||

| Total comprehensive income attributable to ordinary shareholders of the Company | 709,468 | 79,107 | 12,479 | ||||||

Unaudited Reconciliations of GAAP and Non-GAAP Results

| For the Three Months Ended |

|||||||||

| (In thousands, except for share and per share data) | 2021 | 2022 | |||||||

| RMB | RMB | US$ | |||||||

| Reconciliation of Adjusted net income attributable to ordinary shareholders of the Company to Net income attributable to ordinary shareholders of the Company | |||||||||

| Net income attributable to ordinary shareholders of the Company | 711,539 | 78,099 | 12,320 | ||||||

| Add: Share-based compensation expenses | 48,513 | 41,568 | 6,557 | ||||||

| Interest expense associated with convertible notes | 11,134 | 10,939 | 1,726 | ||||||

| Investment loss/(income) | 189 | (1,374 | ) | (217 | ) | ||||

| Adjusted net income attributable to ordinary shareholders of the Company | 771,375 | 129,232 | 20,386 | ||||||

| Adjusted net income per ordinary share attributable to ordinary shareholders of the Company | |||||||||

| Basic | 2.10 | 0.35 | 0.06 | ||||||

| Diluted | 1.86 | 0.31 | 0.05 | ||||||

| Adjusted net income per ADS attributable to ordinary shareholders of the Company | |||||||||

| Basic | 4.20 | 0.70 | 0.11 | ||||||

| Diluted | 3.72 | 0.62 | 0.10 | ||||||

| Weighted average number of ordinary shares outstanding attributable to ordinary shareholders of the Company | |||||||||

| Basic | 367,370,488 | 370,068,984 | 370,068,984 | ||||||

| Diluted | 414,600,356 | 414,932,685 | 414,932,685 | ||||||

Unaudited Reconciliations of GAAP and Non-GAAP Results

| For the Three Months Ended |

|||||||||

| (In thousands) | 2021 | 2022 | |||||||

| RMB | RMB | US$ | |||||||

| Reconciliations of Non-GAAP EBIT to Net income | |||||||||

| Net income | 711,081 | 81,483 | 12,854 | ||||||

| Add: Income tax expense | 131,257 | 19,377 | 3,057 | ||||||

| Share-based compensation expenses | 48,513 | 41,568 | 6,557 | ||||||

| Interest expense, net | 19,689 | 15,305 | 2,414 | ||||||

| Investment loss/(income) | 189 | (1,374 | ) | (217 | ) | ||||

| Non-GAAP EBIT | 910,729 | 156,359 | 24,665 | ||||||

Additional Credit Information

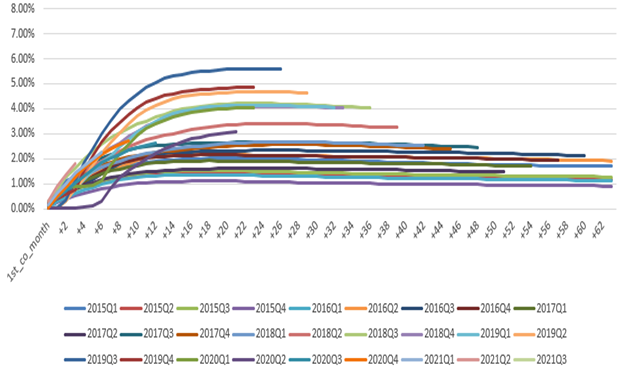

Vintage Charge Off Curve

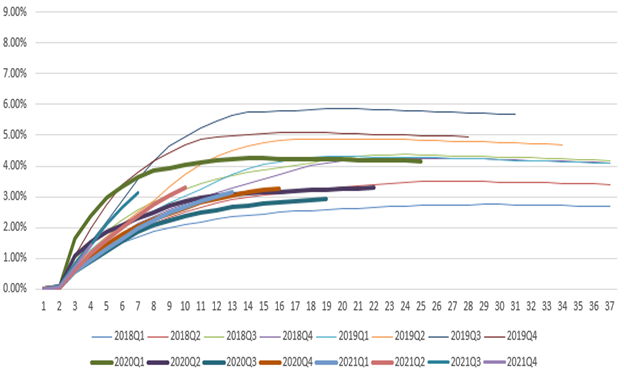

Dpd30+/GMV by Performance Windows

First Payment Default 30+

Source: LexinFintech Holdings Ltd.